Jiangsu Jinhui Color Coated Aluminum Coil 2017 Weekly Aluminum Price Report for the 44th Week (10.30-11.3)

1. Weekly market overview:

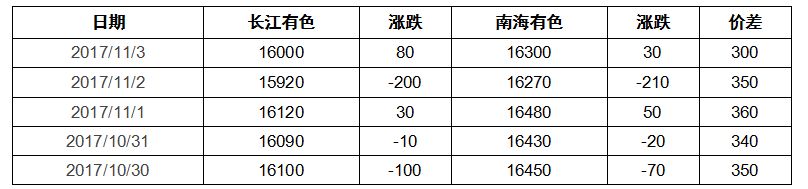

1. One-week domestic main spot prices

This week, the aluminum price continued to fluctuate around 16,000, with a slight negative decline. The price difference between the two places remained around 300. The market is abundant in supply, holders are enthusiastic about selling in high, and the overall trading is average.

2. One-week relevant market performance

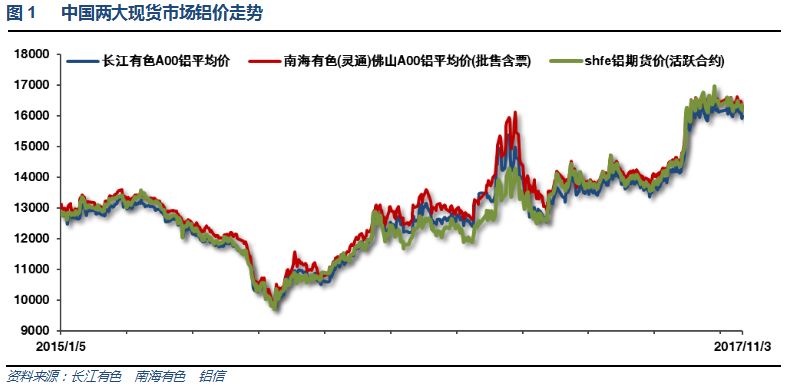

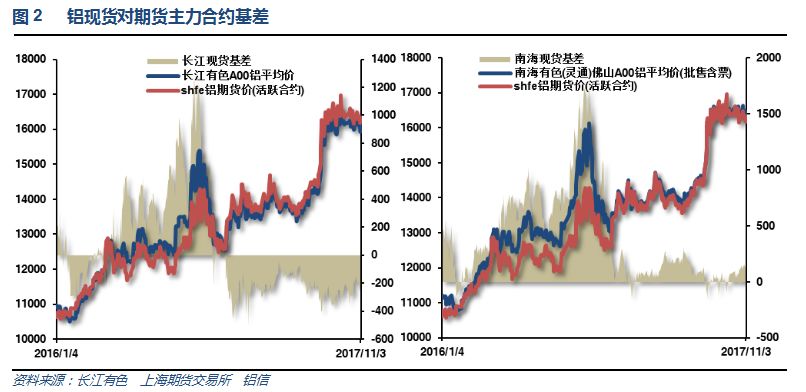

In this cycle, the overall spot price fluctuated slightly, and the basis weakened again. The spot has maintained a weak and strong situation recently.

The performance of Lun Aluminum was stronger than that of Shanghai Aluminum, and the Shanghai-Lun ratio remained around 7.5.

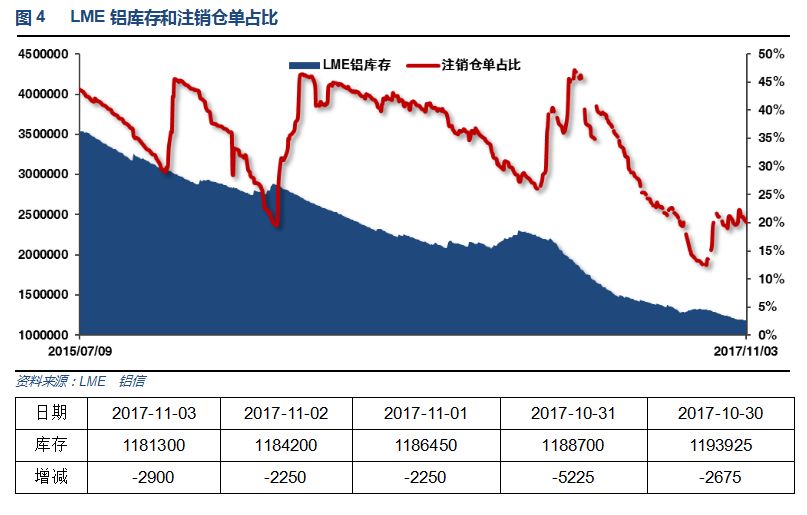

3. Weekly inventory changes

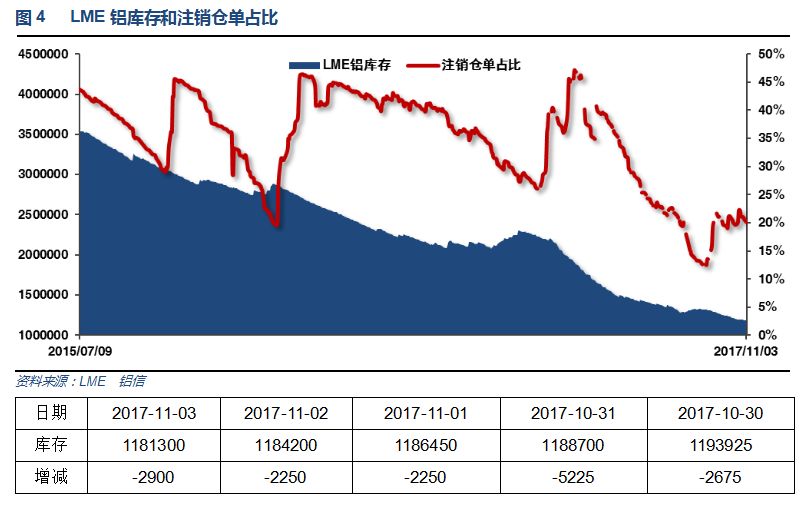

Lun Aluminum's inventory continued to decline this week, and cancelled warehouse receipts accounted for about 20%

The inventory of the previous period continued to decline this week, and the proportion of cancelled warehouse receipts reached about 20%

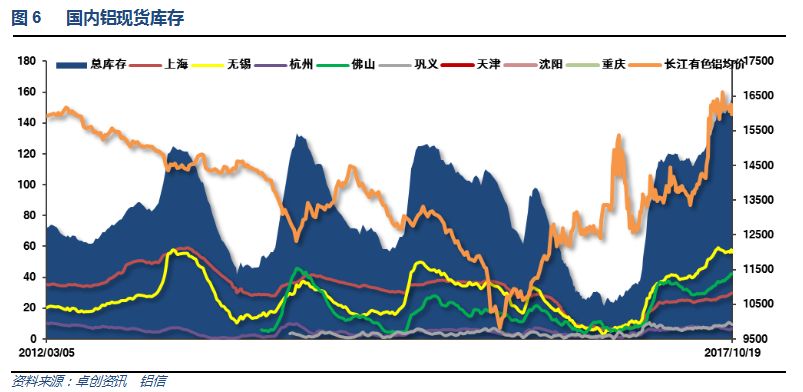

Spot inventory rebounded again, maintaining about 1.65 million tons, and there was no inventory inflection point.

2. A review of the week's highlights:

1. The personal income of the United States in September was 0.4% month-on-month, expected 0.4%, and the previous value was 0.2%. The personal consumption expenditure (PCE) of the United States in September was 1% month-on-month, a new high since 2009, expected 0.9%, and the previous value was 0.1%. The actual personal consumption expenditure (PCE) of the United States in September was 0.6% month-on-month, expected 0.5%, and the previous value was -0.1%.

The US PCE price index in September was 0.4% month-on-month, expected 0.4%, and the previous value was 0.2%. The US PCE price index in September was 1.6% year over year, expected 1.6%, and the previous value was 1.4%. The US core PCE price index in September was 0.1% month-on-month, expected 0.1%, and the previous value was 0.1%. The US core PCE price index in September was 1.3% year over year, expected 1.3%, and the previous value was 1.3%.

The US ISM manufacturing index in October was 58.7, expected to be 59.5, and the previous value was 60.8 - the highest in the past 13 years. The US ISM manufacturing new orders index in October was 63.4, and the previous value was 64.6. The US ISM manufacturing employment index in October was 59.8, and the previous value was 60.3. The US ISM manufacturing price payment index in October was 68.5, expected 67.8, and the previous value was 71.5.

The final value of the Markit manufacturing PMI in the United States in October was 54.6, a new high since January. It is expected to be 54.5, with an initial value of 54.5; the final value in September was 53.1.

The final value of the Markit service industry PMI in the United States in October was 55.3, and it was expected to be 55.9, with an initial value of 55.9; the final value in September was 55.3. The final value of the Markit comprehensive PMI in the United States in October was 55.2, with an initial value of 55.7; the final value in September was 54.8.

U.S. ADP employment in October + 235,000, a new high in March, expected + 200,000, the previous value + 135,000 revised to + 110,000.

The Fed kept its target range for the federal funds rate unchanged at 1.00% -1.25%, as market expectations.

Reiterating that short-term risks to the economy appear to be "roughly balanced", the Fed is keeping a close eye on inflation. Plans to shrink its balance sheet, which began in October, are underway. Core U.S. inflation remained weak, even as higher gasoline prices pushed up headline inflation in September after hurricanes such as Harvey hit parts of the country. Despite the hurricane, economic activity has been growing at a "solid pace" and the job market continues to strengthen. The U.S. economy is expected to adapt to the FOMC's gradual approach to raising interest rates. The policy decision was approved by a unanimous vote of members.

The number of people applying for unemployment benefits for the first time in the week of October 28 in the United States 229,000, and the expected 235,000, and the previous value was revised from 233,000 to 234,000. The number of people applying for unemployment benefits in the week of October 21 in the United States 1.884 million, and the expected 1.894 million, and the previous value was revised from 1.893 million to 1.898 million.

[Trump: Nominate Powell as Fed chairperson to succeed Yellen] No Fed vice chairperson will be nominated this week.

According to the outline document of the House of Representatives Tax Reform Committee, the House Republicans' tax reform plan will set the tax brackets at 12%, 25%, 35%, and 39.6% for the wealthy. The Republican tax reform plan will open up a new version of the family tax rebate measure. The corporate tax will be lowered from 35% to 20%, and no further details will be provided.

The ISM non-manufacturing index of the United States in October was 60.1, a new high since August 2005, and was expected to be 58.5, compared with the previous value of 59.8.

The final value of US durable goods orders in September was 2% month-on-month, expected to be 2%, and the initial value was 2.2%; the final value in August was 2%. The US deducted 1.7% month-on-month final value of aircraft non-defense capital durable goods orders in September, and the initial value was 1.3%; the final value in August was 1.1%. The US deducted 0.7% month-on-month final value and 0.7% initial value of transportation durable goods orders in September; the final value in August was 0.5%.

The U.S. unemployment rate in October was 4.1%, the lowest in nearly 17 years, and was expected to be 4.2%, compared with the previous value of 4.2%. The U.S. labor force participation rate in October was 62.7%, compared with an expected 63.1%, compared with the previous value of 63.1%.

[The number of new non-farm payrolls in the United States in October was less than expected, but the value of the first two months was revised up] The US non-farm payrolls in October + 261,000, the largest increase since July 2016, and the expected + 313,000. The US non-farm payrolls in September were revised to + 18,000, the initial value - 33,000; in August, it was revised to + 208,000, the initial value + 169,000 (the cumulative upward revision 90,000 in the previous two months). The US private sector employment population in October was + 252,000, expected + 302,000, and the previous value was revised from - 40,000 to + 15,000. U.S. manufacturing employment in October + 24,000, expected + 15,000, the previous value was revised from - 1,000 to + 6,000.

2. The initial value of the euro area's October CPI year over year is 1.4%, which is expected to be 1.5%, and the previous value is 1.5%. The initial value of the euro area's October core CPI year over year is 0.9%, which is expected to be 1.1%, and the previous value is 1.1%.

The euro zone unemployment rate in September was 8.9%, compared with expectations of 9%, and the previous value of 9.1% was revised to 9%.

Eurozone GDP in the third quarter was 0.6% from the initial value, expected 0.5%, and the previous value of 0.6% was revised to 0.7%. Eurozone GDP in the third quarter was 2.5% year over year, expected 2.4%, and the previous value was 2.3%.

The final value of the manufacturing PMI in the euro area in October was 58.5, a new high since February 2011. It is expected to be 58.6, the initial value is 58.6; the final value in September is 58.1.

[Bank of England raises interest rates for the first time since 2007] Bank of England interest rate decision 0.5%, expected 0.5%, the previous value of 0.25%.

Bank of England meeting notes: The Monetary Policy Committee (MPC) voted 7-2 (expected 6-3) to raise interest rates. Two deputy governors, Ramsden and Cunliffe, disapproved of raising interest rates, saying there was insufficient evidence that wage growth would meet Bank of England expectations. MPC kept the scale of government bond purchases unchanged at 9-0; kept the scale of corporate bond purchases unchanged at 9-0.

3. China's official manufacturing PMI51.6 in October was a three-month low, expected to be 52, and the previous value was 52.4. China's official non-manufacturing PMI54.3 in October was 55.4.

China's October Caixin manufacturing PMI 51, expected 51, the previous value of 51. China's October Caixin service industry PMI 51.2, the second lowest level of the year, the previous value was 50.6. China's October Caixin composite PMI 51 fell to a 16-month low, the previous value was 51.4.

4. The performance of the cash market last week was lackluster. Near the end of the month, some cargo holders are eager to withdraw funds. In addition, the year is not far away, the enthusiasm of cargo holders to sell in the market is enhanced, and the supply of goods in circulation is very abundant; on the other hand, downstream consumption is average. Among them, East China is relatively fast. Recently, the daily output of aluminum ingots in Wuxi has been at the level of 5,000-6,000 tons, while the average daily output of aluminum ingots + aluminum rods in Guangdong is around 11,000 tons. Guangdong seems to be slightly better. Affected by this, the market showed a situation of oversupply, and the spot transaction price/discount for the month did not narrow significantly - the spot transaction price in Guangdong during the week/discount for the month was basically maintained at the level of 50-80 yuan; while the spot transaction price in East China/discount for the month was still maintained at the beginning of the week. At the beginning of the week, it was still around 90-110 yuan, and it expanded to 130-150 yuan again on Thursday and Friday, showing that after the price rose sharply, the cardholders actively sold in the stock market and the purchasers were slightly on the sidelines. The cash market did not look optimistic about the outlook price, and took advantage of the high active selling in many cardholders The top choice.

In terms of inventory, as of last Thursday, the total domestic social inventory was 1.718 million tons, a decrease of 24,000 tons per week. Among them, the social inventory of aluminum ingots in Guangdong was 420,000 tons, and the weekly ratio was the same; the social inventory of aluminum ingots in East China was 1.099 million tons (including Shanghai inventory 346,000 tons, Wuxi inventory 663,000 tons, and Hangzhou inventory 90,000 tons), and the weekly ratio decreased by 6,000 tons (of which Shanghai increased by 8,000 tons, Wuxi decreased by 17,000 tons, and Hangzhou increased by 3,000 tons); Gongyi inventory 112,000 tons, and the weekly ratio decreased by 16,000 tons; Tianjin inventory 56,000 tons, and the weekly ratio was flat; Chongqing inventory 31,000 tons, and the weekly ratio decreased by 2,000 tons. The large-scale production reduction caused by the reduction of production capacity has gradually begun to be reflected, and the arrival of goods in coastal areas has decreased recently. However, there are still great uncertainties in consumption. Among them, the construction of small and medium-sized enterprises in the lower reaches of Guangdong is mostly in the range of 6-7%, and large enterprises are producing at full capacity, and their performance is acceptable. Only affected by environmental protection, the aluminum rod is relatively strong, and the aluminum ingot outbound still has not improved significantly. This week, the outbound volume of aluminum ingots in Guangdong was 40,400 tons, a slight decrease from the previous week, a decrease of about 1,400 tons. Consumption in East China is not satisfactory, slightly inferior to Guangdong, but overall consumption has not shown signs of deterioration, and inventory is expected to show a slight downward trend.

Guangdong aluminum rod inventory continued to decline. As of last Friday, Guangdong aluminum rod inventory was 115,600 tons, a decrease of 17,100 tons week-on-week, and the inventory decline was significantly expanded. On Thursday, the futures price of aluminum rebounded sharply, and the processing fee for aluminum rods fell. Among them, the processing fee for Guangdong 90mm aluminum rods fell from 370-470 yuan/ton to 260-360 yuan/ton, the processing fee for 120mm aluminum rods fell from 350-450 yuan/ton to 240-340 yuan/ton, and the processing fee for 178mm aluminum rods fell from 300-400 yuan/ton to 220-320 yuan/ton. Last week, the output of aluminum rods was 31,100 tons, an increase of 2,700 tons over the previous week. The previous week's Friday and weekend deliveries reached 12,800 tons, a new high since the end of June. On the demand side, the downstream start-up performance was stable. Although manufacturers generally said that the start-up rate was lower than the same period last year, as the downstream environmental protection production was further tightened as winter approached, the demand for aluminum rods increased; on the supply side, the production reduction in Weiqiao in Shandong Province led to a significant reduction in the production of surrounding aluminum rod factories. In addition, the demand for aluminum rods in Jiangxi and other places has improved significantly. The price advantage is stronger than that in Guangdong, and the volume of manufacturers' shipments to Guangdong has decreased. Last week, the volume of aluminum rods in Guangdong fell by about 30% compared with the previous week.

From January to September, the profit of non-ferrous metal smelting and rolling processing industry increased by 47.1%. From January to September, among industrial enterprises above designated size, state-controlled enterprises realized a total profit of 1.25774 trillion yuan, an increase of 47.6% year over year; collective enterprises realized a total profit of 32.34 billion yuan, an increase of 4.3%; private enterprises realized a total profit of 1.82859 trillion yuan, an increase of 14.5%.

In the first three quarters, the national output of ten non-ferrous metals 40.73 million tons, an increase of 4.1% year over year, and the growth rate increased by 3.2 percentage points year over year. Electrolytic aluminum production 24.66 million tons, an increase of 5%, and a decrease of 1.4% in the same period last year.

3. Futures price analysis:

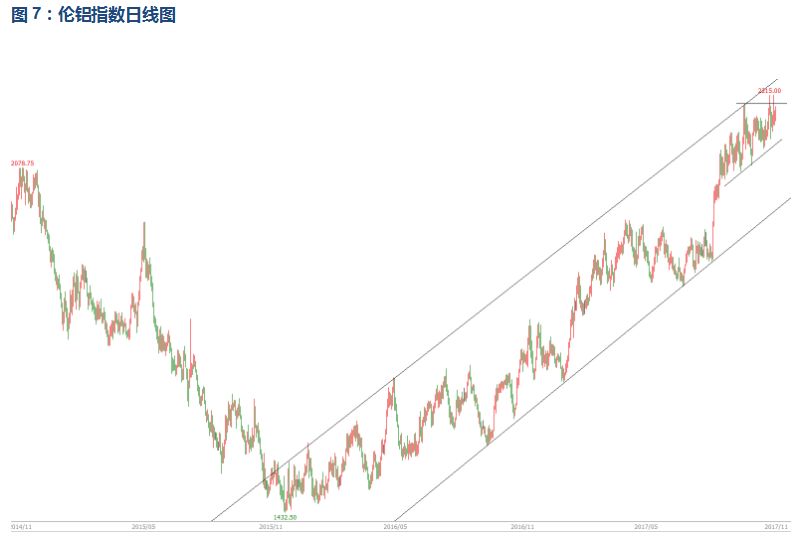

The mid-term rise of Lun Aluminum continued, and the short-term repeated impact on 2200 was not successful for the time being, and the concussion rose

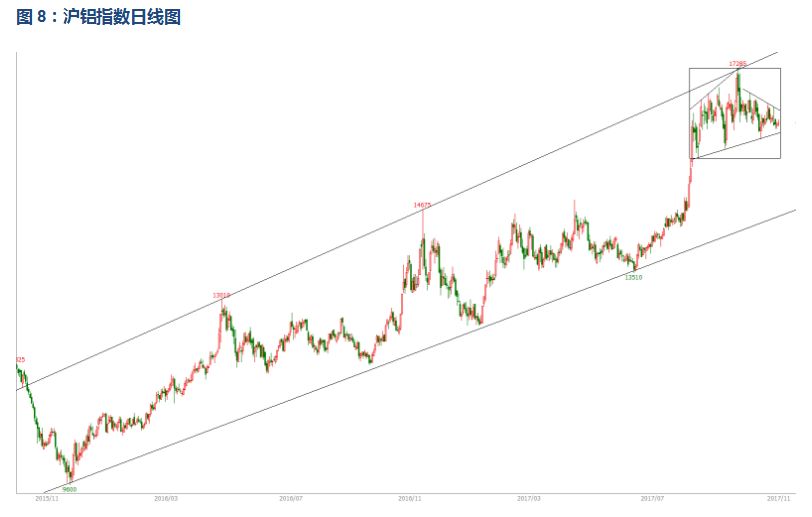

The long-term rise of Shanghai Aluminum continued, the medium-term continued to fluctuate sideways, and the short-term weakness fell

4. Next week's aluminum price analysis:

This week, the aluminum price continued to fluctuate around 16,000, with a slight negative decline. The price difference between the two places remained around 300. The market is abundant in supply, holders are enthusiastic about selling in high, and the overall trading is average.

According to the market chart, the mid-term rally of Lun Aluminum continued, and the short-term repeated impact of 2200 was not successful for the time being, and the shock disk rose. The long-term rally of Shanghai Aluminum continued, the medium-term continued to fluctuate sideways, and the short-term weakness fell.

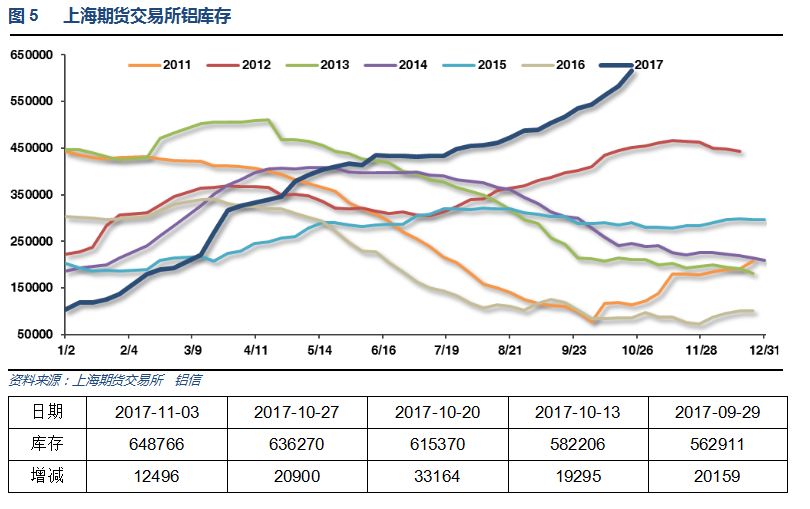

From a macro perspective, the economic data released today from China, the United States and Europe are generally moderate and positive. The Federal Reserve's FOMC meeting notes show that another interest rate hike in December is almost certain. The United Kingdom also raised interest rates for the first time in ten years. The overall overseas economic environment has improved. However, due to the fact that monetary stimulus policies began to be reduced at the same time, the overall macro neutral preference. The industry fundamentals are relatively stable. Domestic spot inventories continue to accumulate, with a total of more than 2.3 million tons. Futures inventories continue to increase, and spot inventories remain near 1.65 million tons without a significant decline. From a policy perspective, the expectation of off-peak production restrictions in winter continues to support aluminum prices, and support around 16,000 is still effective. From the perspective of futures disk, industrial products continued to fluctuate as a whole, non-ferrous metals performed strongly, and Shanghai Aluminum maintained a weak decline in box shocks in the short-term. Next week, aluminum prices are expected to remain volatile, for reference only.

Related news

Shanghai futures rose 140 yuan last night

Last night, Shanghai futures aluminum rose 140 yuan, and it is expected that the Yangtze River spot will rise slightly today.

Jiangsu Jinhui Color Coated Aluminum Coil Information: WIND data shows that as of December 28, the base metal index has risen by 19.55% this year, and electrolytic aluminum is a hot topic in class A share investment this year. Wang Daobin, a researcher at Huashang Fund, said that in 2016, with the smooth advancement of the supply-side reform of the coal and steel industries, the profitability of the industry has recovered rapidly, which will undoubtedly give the electrolytic aluminum companies that have been losing money all year round the hope of seeing an inflection point in the industry. With the active promotion of state-owned enterprises, the supply-side reform of electrolytic aluminum kicked off. Stimulated by the supply-side reform policy of electrolytic aluminum and the expected impact of environmental protection, the price of electrolytic aluminum in 2017

1. The most vigorous Mid-Autumn Festival poem - "Looking at the Moon and Huaiyuan" (Tang Zhang Jiuling) The bright moon is born at sea, and the world is at this time. Lovers complain about the distant night, but they start to miss each other at night. Candles are full of pity, and I feel dewy when I wear clothes. I can't bear to give it away, and I still dream of a good time. Comments: Zhang Jiuling is a famous figure of the Tang Dynasty. He was ostracized by traitors and relegated to Jingzhou. On the night of the Mid-Autumn Festival, I miss the distance, so I wrote this poem. The poem has a strong and broad artistic conception, strong bones, but sincere emotions, especially the first two sentences have long been famous sentences for ages. 2. The loneliest Mid-Autumn Festival poem - "Fifteen Nights Looking at the Moon" (Tang Wangjian) In the atrium, the white trees perch on crows, and the cold dew and silent wet osmanthus flowers. Tonight, the moon is bright and people are looking forward to it,

Eight Songs of Ganzhou · To Xiaoxiao Twilight Rain

On the river and the sky are the dashing twilight rains, and the autumn is washed away. The frost and the wind are tight, the river is deserted, and the building is shimmering. It is a place where the red is fading and the green is fading, and the scenery is fading. There is only the water of the Yangtze River, which flows eastward without words. I can't bear to climb high and far away, I look at my hometown in the distance, and it is difficult to return to my thoughts. I sigh over the traces of the past few years, what is it that has been so difficult to drown? I miss a beautiful woman, I look at the makeup tower for a long time, I miss a few times, and I know how to return to the boat in the sky. Strive to know me, leaning on the pole, I am so worried!

The rain is bleak, burning an incense, lighting a cup of tea, holding a volume of books, and between the lines of the Book of Songs, feel the earliest romance of mankind~ 1. There is a beautiful person, clear and gentle. Encounters and encounters are suitable for my wishes. - Translation of "The Book of Songs · Zheng Feng · Ye Has Vine Grass": The countryside is green and green, covered with dewdrops and crystal clear. There is a beautiful girl whose eyebrows are looking forward to conveying love, which made me fall in love at first sight. 2. Jianjia is pale, and white dew is frost. The so-called Yiren is on the side of the water. - Translation of "Book of Songs, National Wind, Qin Feng, Jianjia": The reeds are green and green, and the dew condenses into frost. The sweetheart you love is on the other side of the water. 3. He is desolate, not seeing each other for a day is like three autumns

Until the Double Ninth Festival, the chrysanthemum will come again

The Double Ninth Festival (also known as: Old Man's Day), on the ninth day of the ninth month of the lunar calendar every year, is a traditional festival of the Han nationality. Because the "Book of Changes" sets "six" as the yin number and "nine" as the yang number, on September 9th, the sun and the moon are combined with the yang, and the two nines are heavy, so it is called the Double Ninth Festival, also called the Double Ninth Festival. The Double Ninth Festival was formed as early as the Warring States Period. In the Tang Dynasty, the Double Ninth Festival was officially designated as a folk festival, and it has been followed by successive dynasties since then. There is a folk custom of climbing high on this day, so the Double Ninth Festival is also called the "Ascending Festival", in addition to the Dogwood Festival, Chrysanthemum Festival and other sayings. When people celebrate the Double Ninth Festival, they usually climb high, enjoy chrysanthemums, drink chrysanthemum wine, put dogwood, and eat cakes. In addition,